XXX

Two markets, one great potential.

Investors, financial institutions, project developers, property owners, or municipalities – all of them can benefit from technological innovations in the real estate market to create sustainable value for various types of use. Through data analysis systems, it is possible to measure, evaluate, and predict accurately throughout the entire real estate cycle in every micro-location in Germany, enabling the right investment decisions. These data analyses also make it possible to identify potential values in the energy sector. This includes assessing suitable areas for solar and wind parks and developing innovative projects such as urban district heating and cooling systems through the targeted utilization of waste heat from data centers. A current example of this is the Bluestar project, where up to 244,000 kWh of waste heat energy is being utilized from the largest urban data center in Berlin.

Developed and implemented by PREA, we, as a highly specialized consultancy service, use our proprietary software solution to create sustainable value enhancements for investors, owners, and users across the entire real estate, infrastructure, and energy sectors. In a conversation with PREA CEO and founder Gabriel Khodzitski.

Mr. Khodzitski, with Bluestar, PREA is reaching a milestone.

This project underscores our commitment to sustainable energy generation and the integration of technology into energy infrastructure. It serves as an exemplary concept aimed at transforming the development of data centers towards a more energy-efficient and sustainable utilization. However, we are a data-driven company and see our role as much broader. We are constantly searching for innovative ways to shape the real estate and energy markets and to think beyond boundaries through artificial intelligence.

What does this look like in concrete terms?

So, is it a kind of combination of the energy and real estate markets as a lifeline in ongoing times of crisis?

Since when has PREA been in the market?

What goals are you continuing to pursue?

Insights for the Energy Market

Two growth markets in focus: Renewable Energy and Data Centers

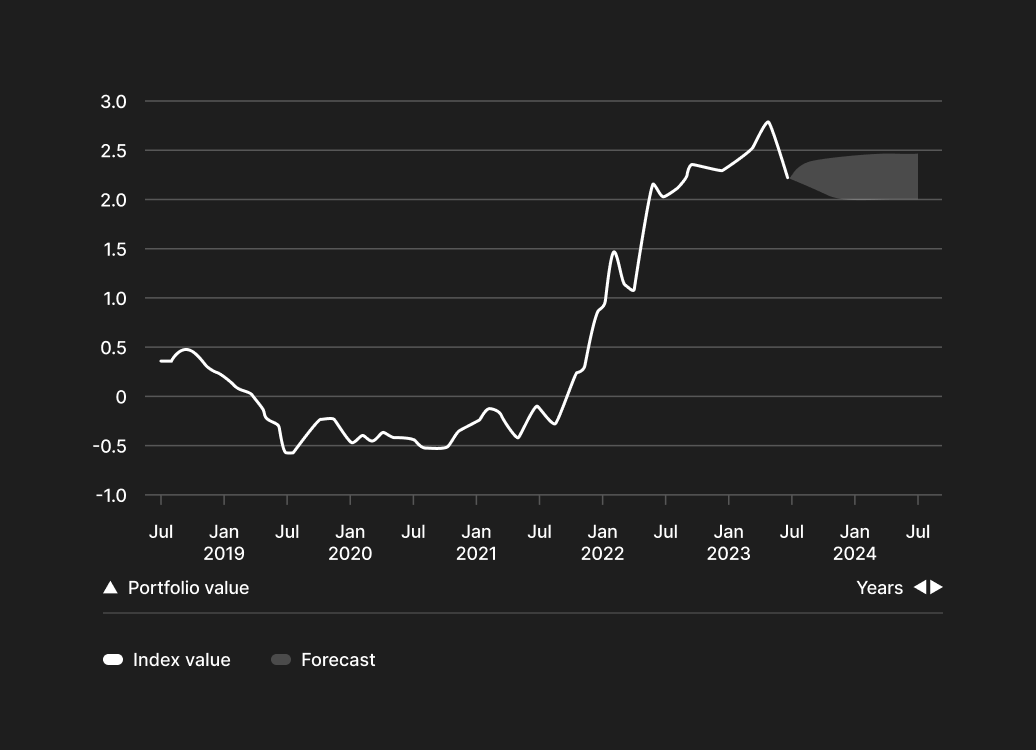

Opportunities in times of rising inflation and interest rates

Investment activity remains low despite increased supply

A significant increase in investment activity in the real estate market is expected only when property prices have adjusted to the current market level. Whether this will happen in the coming year remains to be seen. It is anticipated that the supply will increase next year as the portfolios of many portfolio holders are likely to be devalued in year-end evaluations, while the value of their loans will remain the same. This could force them to reduce their holdings. However, it remains uncertain whether the increased supply will also lead to a resurgence in demand. It is evident that the current environment for real estate investors and portfolio holders has become more challenging. In traditional real estate market segments such as residential, office, or retail, properties with attractive yield levels are currently offered only sporadically. Compounding the difficulty is the ongoing increase in construction costs. Currently, this is affecting developers and project developers particularly strongly. Due to the time lag between construction and marketing, they had calculated with higher exit prices, which cannot be achieved now due to the increased yields. Consequently, several prominent project developers have already succumbed to market consolidation this year, including Gerchgroup, Development Partner, the Project Group, Euroboden, and most recently, Signa.

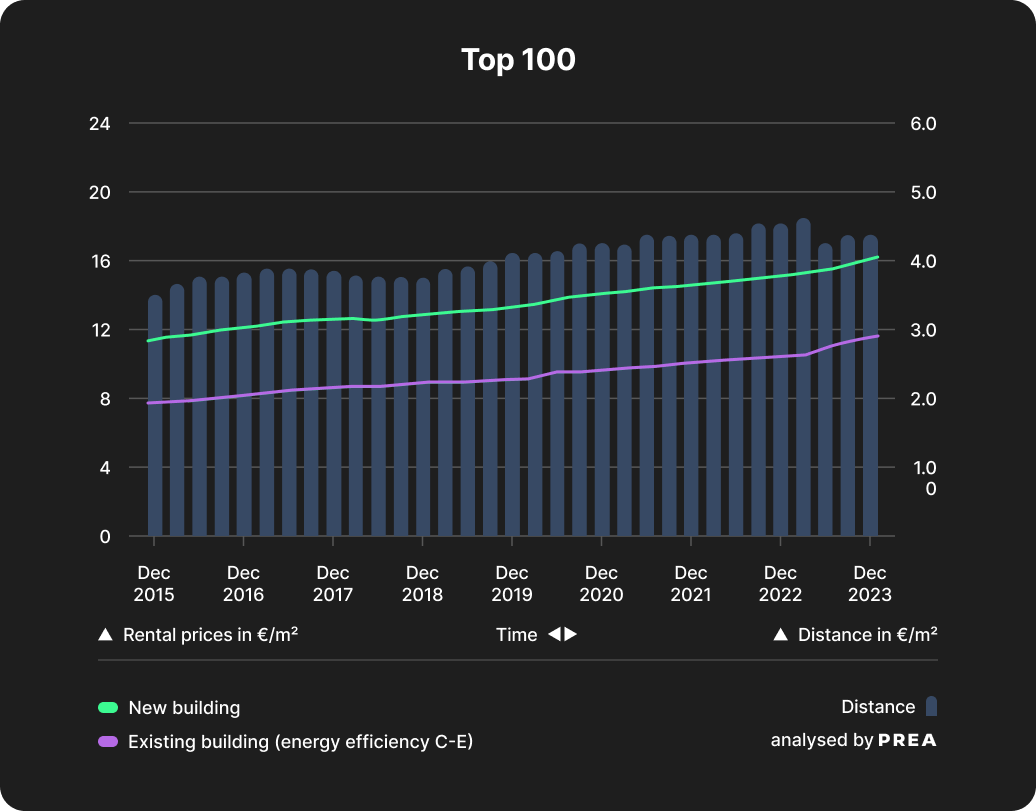

Nevertheless, even in the current challenging market environment, there are segments where significant value appreciation can be achieved: the market for renewable energy and data centers. Below, we explain why both market segments have tremendous growth potential.

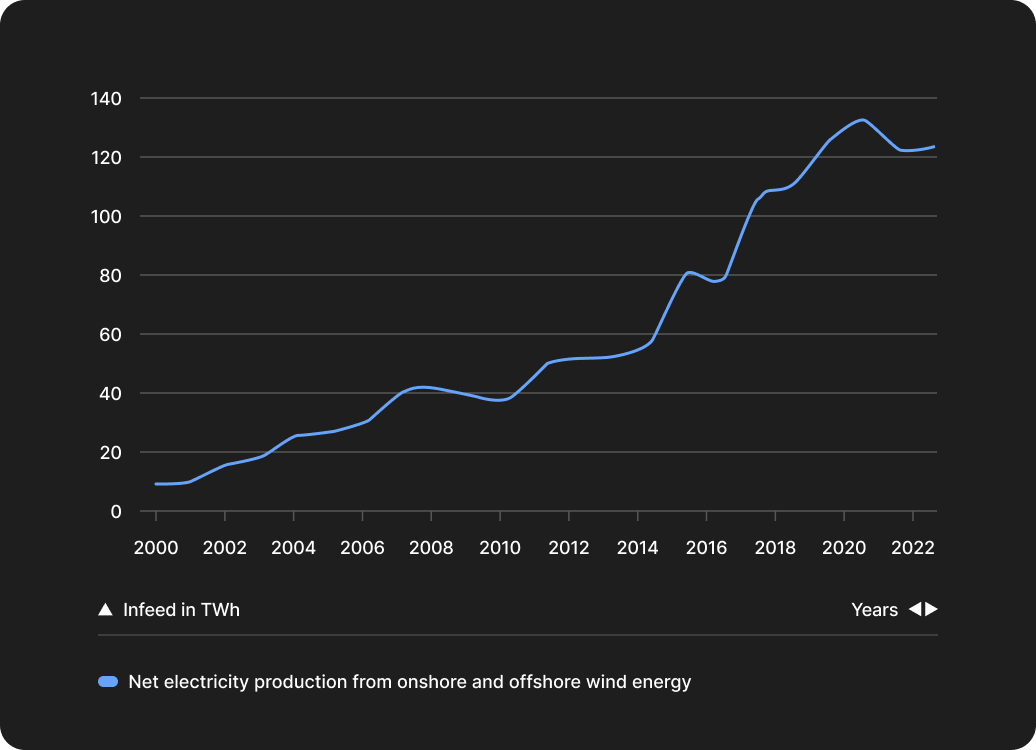

Renewable Energy: growth market for the coming decade

The war in Ukraine and the discontinuation of Russia as an energy supplier for Germany have led to a sudden increase in energy prices. This has heightened the political pressure to make the energy supply less dependent on non-EU countries, in line with climate protection goals, through an expansion of renewable energy. The share of gross electricity consumption is expected to increase to at least 80% by 2030.

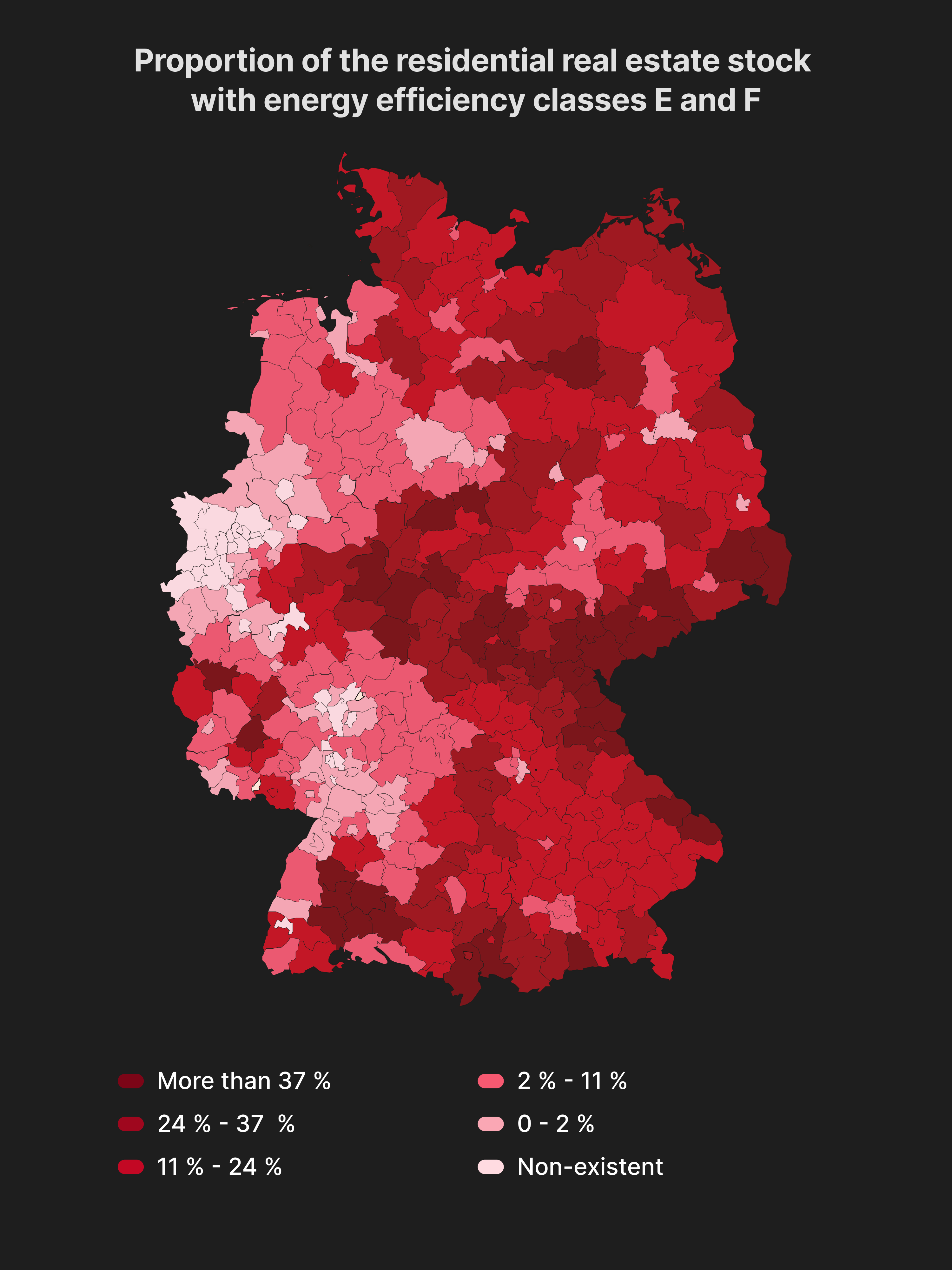

Green Energy in the building stock: more sustainable and fairer than renovation

The energy output is growing, but so is the demand

The north is on track, the south lags behind in the expansion

Never before has so much Solar Energy been installed

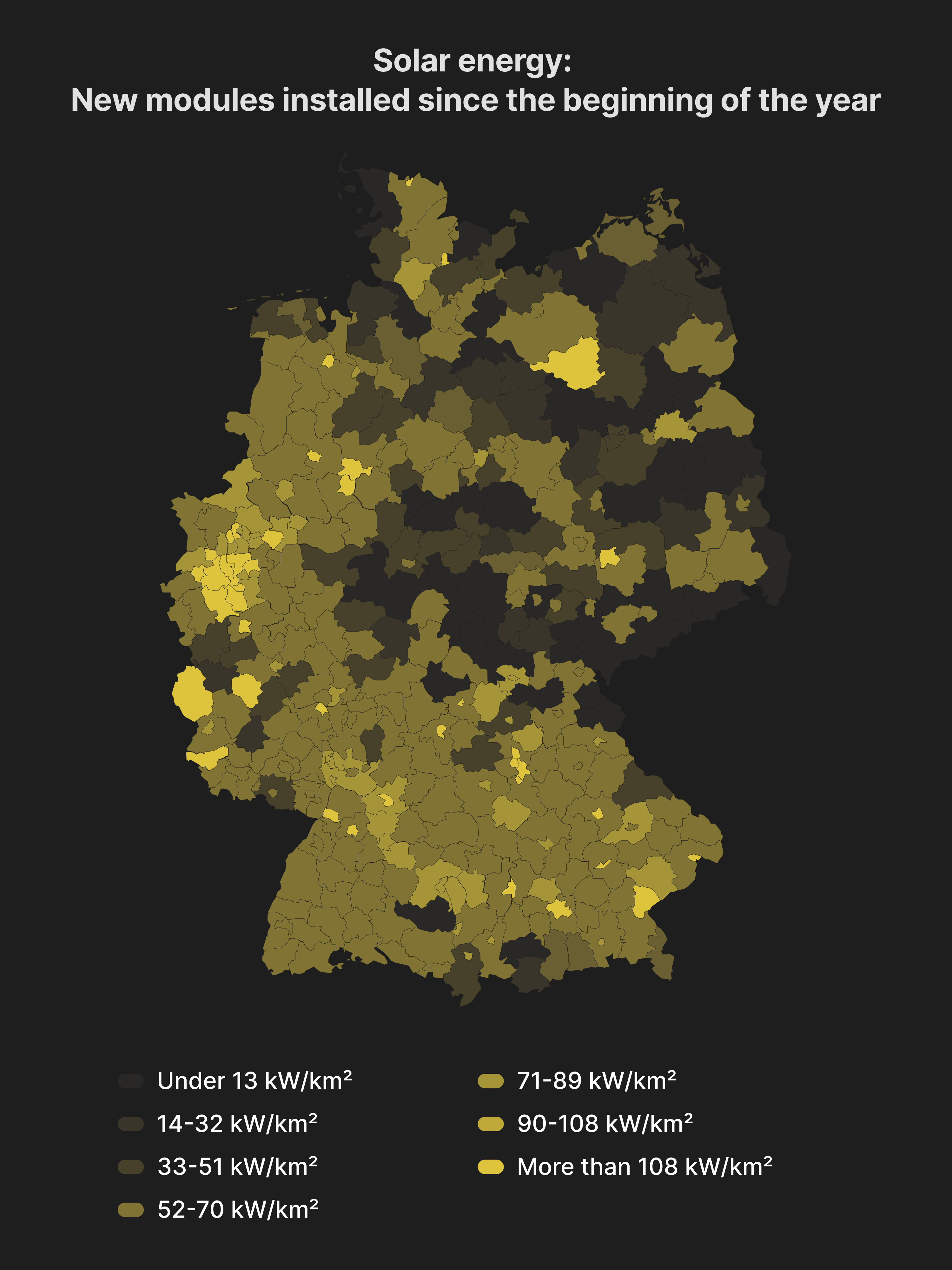

Due to the substantial growth of solar energy in the southern and western regions, the expansion of solar energy is currently advancing at an unprecedented pace. Never before has so much solar energy been installed as in the year 2023. This year, 51% more solar energy was connected to the grid than the annual target projected.

The situation is different for the installed capacity of new wind turbines. Currently, Germany is 24% below its plan. Moreover, the pace of expansion has rapidly declined since 2017. Back then, a different subsidy model was in place. Since then, wind turbines must be tendered nationwide, leading to a slowdown in expansion. However, the federal government is optimistic that with the new Wind-on-Land Act and changes to the Federal Nature Conservation Act, the expansion will proceed much faster in the future.

Another turning point: Data Centers are also on the rise

Not only is the market for renewable energies a growth market with strong anticipated growth rates, but so is the market for data centers. In an increasingly digitized world, data centers will play an ever-growing role. They are already a crucial component of modern information and communication technology and are expected to further solidify their position in supporting business processes, securing data, and providing cloud services.

- Some areas that are currently experiencing significant growth include:Increasing Data Traffic: The continuous rise in data traffic, especially due to technology trends like the Internet of Things (IoT), artificial intelligence (AI), and Big Data, is driving the need for storage and computing capacity.

- Cloud Computing: Companies are increasingly relying on cloud computing services to optimize and make their IT infrastructure more flexible. This results in a growing demand for data centers that support these cloud services.

- Digitalization of Businesses: As part of digital transformation, businesses are investing heavily in IT infrastructure to remain competitive. This includes expanding data centers to meet the growing demands for data processing and storage.

- Edge Computing: The widespread adoption of edge computing, where data is processed closer to the source to reduce latency, requires a decentralized infrastructure. This leads to a demand for smaller, distributed data centers to meet the requirements of edge computing.

- 5G Technology: The expansion of 5G networks opens up new possibilities for real-time data transmission. This results in an increased need for data centers to process the growing amount of data generated by 5G-enabled devices.

- Cybersecurity: With the increasing threat of cyberattacks, companies are investing heavily in security infrastructure, including highly secure data centers, to protect their data.

Currently, we are only witnessing the beginning of growth through digitization. For this reason, the widespread and especially inner-city supply of data centers will play an even more important role in the future. This includes the growth market of Green Computing, where environmentally friendly IT solutions are offered with data centers powered by sustainable energy sources. The advantage is that these solutions align with the German government’s strategy to become independent of fossil fuels. The data center market not only offers attractive opportunities due to increasing digitization but also provides additional returns by selling the waste heat to households supplied with district heating. This is particularly lucrative as district heating prices have recently increased significantly, while electricity prices have declined since their peak in September 2022.

A weak office market provides opportunities for the expansion of data centers

Furthermore, the low demand for office space due to the growing prevalence of remote working presents opportunities to meet the increasing need for data centers. Typical back-office locations currently do not command rents that would justify the development of office properties. Additionally, office employees prefer inner-city office spaces. It is worth considering whether the infrastructure allows for the development of data centers in these locations. Acquiring spaces that were formerly designated for office use is currently cost-effective. Replanning a data center on these sites is permissible without the need for a new zoning procedure, and with the appropriate sustainability concept, it can be realized in a relatively short time. In locations with adjacent residential areas, the waste heat can also be utilized.

Conclusion

The real estate market is currently facing challenges due to increased inflation and high interest rates, leading to a decline in activity in the real estate investment market over the past two years. Improvement is not currently in sight, and if the supply-demand dynamics do not adjust in the coming year, a standstill is likely to continue.

However, in this challenging environment, two market segments stand out – renewable energies and data centers – both promising growth areas in the coming years.

Renewable Energies

The rising energy prices, following the cessation of Russian deliveries due to the war in Ukraine, have increased the political pressure to accelerate the expansion of renewable energies.

This market offers excellent growth opportunities, especially for property owners. They have the opportunity to supply their tenants with green energy through direct contracts. Tenants benefit from a lower electricity price compared to traditional providers, and landlords benefit from a higher purchase price compared to the feed-in price. This not only makes landlords environmentally friendly but also socially responsible, positively impacting their ESG scoring in both the environmental (E) and social (S) aspects.

Data Centers

In an increasingly digitized world, data centers play a key role in supporting business processes and providing cloud services. Growth areas that are already evident today include increasing data traffic, cloud computing, digital transformation of businesses, edge computing, 5G technology, and cybersecurity. All of these require an expansion of digital infrastructure, with data centers playing a key role.

The market for data centers complements the strategy of the German government to become independent of fossil fuels. Data centers are essential in a more digitized world, and their waste heat can be used to supply households with district heating. When operated with green energy, data centers are also environmentally friendly.

Author